Software should empower its users not dictate their business processes. Smart solutions from PCIS get out of the way of the claims adjustor, underwriter, risk manager and allow them to focus on their work. Our tech’s core capabilities unlock the potential to eliminate paper, automate compliance, and utilize data in real time for business intelligence.

First and foremost we are technologists, looking to advance the P&C world through the introduction of game changing software. Whether pioneering the Work Comp SaaS model, tackling 50 state FROI/SROI reporting, or embedding wearable technology into the underwriting process we strive to set the bar in the Claims, Risk Management and Underwriting space.

As a company we learned a long time ago that in this industry it is vital to have team members equally experienced in the business side as they are in software. On average our team has 5 years of insurance/risk management experience as well as 9 of tech.

PCIS is built around its professional services group, making every effort to be account centric. Implementation, Conversion, and Maintenance are a science to us in which we approach in a methodical and full serviced way leaving the burden of a system transformation unto us, the people who designed the solution. We don’t hand our client’s a blank slate, we work with them to configure a tailored solution.

3,675,000+

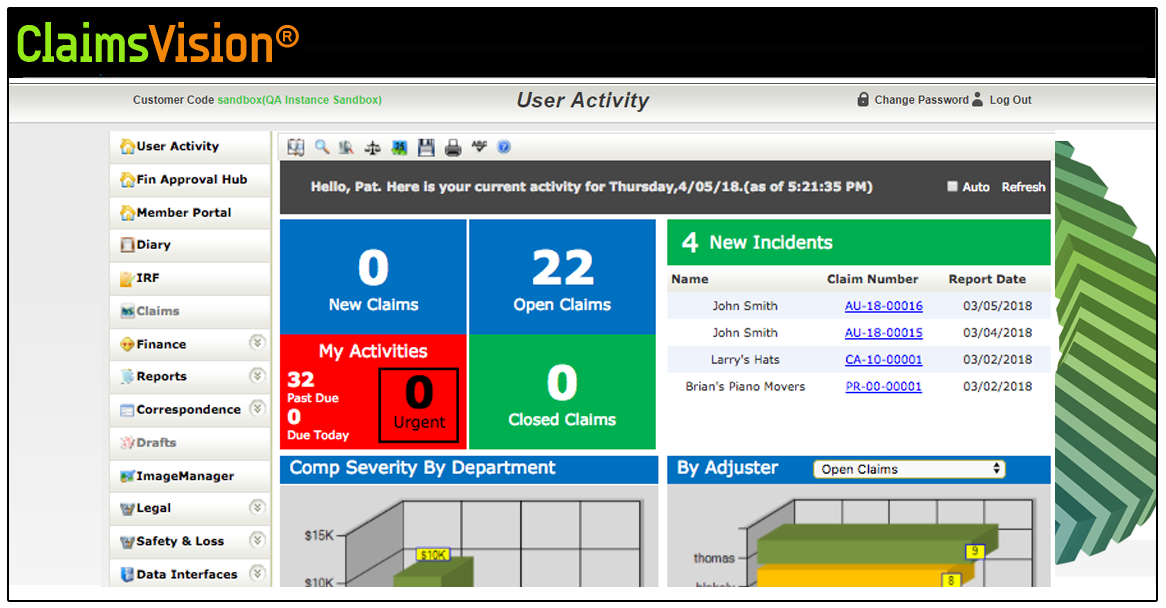

Core claims administration solution handling everything from opening a claim to closing it for all commercial lines including: Work Comp, General Liability, Property, Commercial Auto, Professional Liability, Med Mal, and more.

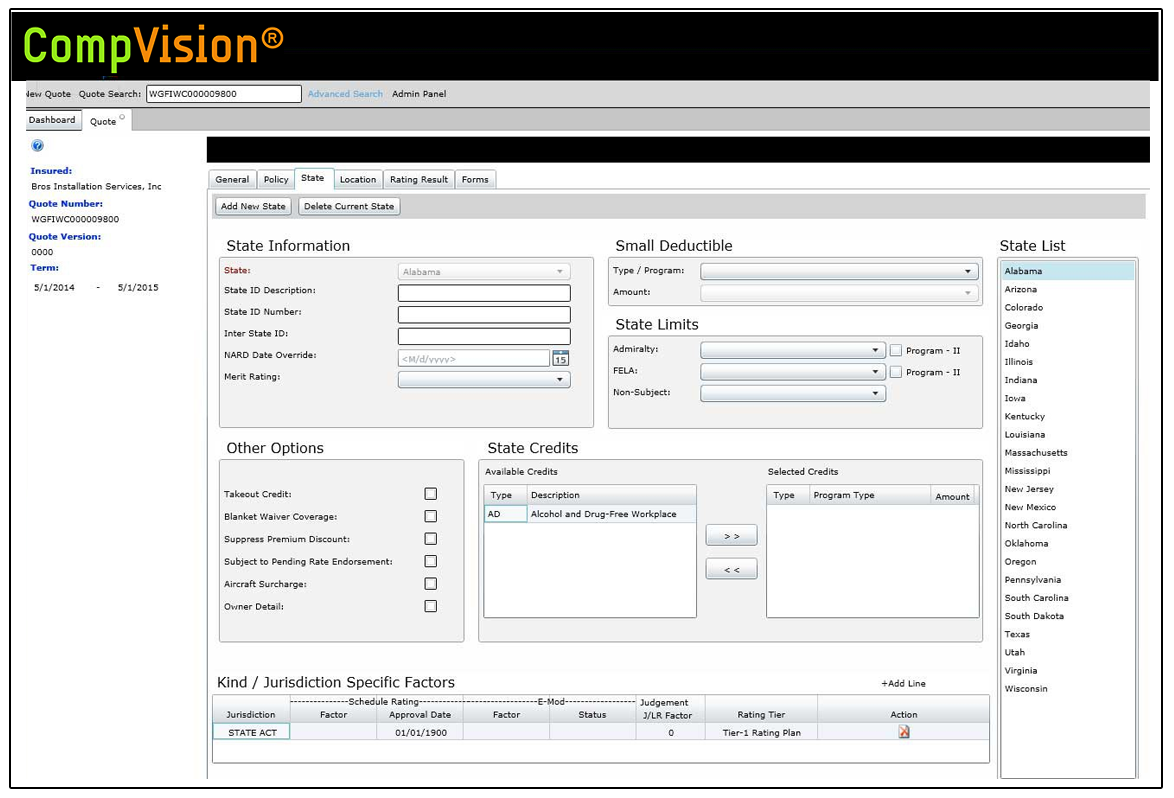

Workers Compensation PAS handling multi-company, 50-state quote, rate, policy issuance, policy administration, premium accounting, audit, and NCCI compliance reporting.